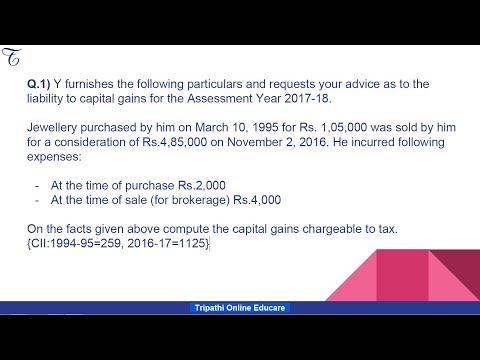

In this video, people compute the capital gain of Mr. Wai. Let us see what is given in this problem. Mr. Wai furnishes the following particulars and requests your advice as to the liability to capital gain for the assessment year 1718. Jewelry purchased by him on 10th March 1995. Before we proceed, let us try to understand whether jewelry is a capital asset or not. So if you see, it is clearly mentioned that a capital asset refers to any property excluding the following specified assets. So in this case, if you see point number 2, it is given that any person affects that is verbal property for personal use, it is not a capital asset because it is excluded. However, jewelry is considered to be a capital asset. So jewelry is a capital asset. This is clear. Even though generally it is personal and movable, still it will be considered as a capital asset. So we have understood that jewelry is a capital asset. And on the sale of jewelry, if we generate profit, we are liable to pay capital gain taxes. Now let's see what they are saying. Jewelry is purchased by him on 10th March 1995. So he bought this jewelry after 131. So you should remember that there are different cases or different situations in taxation. For each and every situation, the formula for index cost of acquisition differs. Now in this case, he is buying this well after 131. So let's see the formula for index cost of acquisition. If any asset is acquired after 1481, the formula for index cost of acquisition will be actual cost of acquisition into index of year of transfer upon index of year of acquisition. And the formula for index cost of improvement will be actual cost of...

Award-winning PDF software

1125-e percent of stock owned Form: What You Should Know

For more information on the form, click here. This page will be updated in real-time with the latest information regarding a filing. If you are unsure if you need to file a Form 1125-E, use our interactive guide below or call us toll-free at.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 1125-E, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 1125-E online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 1125-E by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 1125-E from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1125-e percent of stock owned